Marine Market Side –

Spot Market.

N/A

Weekly Summary.

N/A

Shipping Market Overview by Vessel Segment –

| Shipping Market Overview by vessel segment |

| Tanker : More VLCCs could return to the trading fleet if Opec+ sticks with its existing production increases when it meets this week, a top broker has warned. However, oil prices recently hit a three-year high, flirting with $80 a barrel, and there is pressure from consumers such as China for more supply. "This coming week, Opec and allies are meeting to decide on whether they will remain on the current plan of production increases until the end of the year or modify it to better address rising global oil demand," McQuilling Partners sai Container : Transpacific container freight rates have experienced their first significant drop in weeks, reflecting efforts by carriers to increase capacity on the trade. Spot rates from Asia to North America dropped a chunky 16% ahead of the Golden Week holidays in China in what some believe is the beginning of the end to an extraordinary peak season. Rates from Asia to the US west coast dropped to $16,153 per 40-foot equivalent unit (feu) on Thursday, a $3,029 slump from seven days earlier, according to the Freightos Baltic Global Container Index (FBX). Those from Asia to the US east coast were also down a chunky $3,523 over the same period to $18,711 per feu. The fall comes after sustained efforts by ocean carriers to significantly increase capacity on the lucrative trade. Bulk : Capesize bulkers rates continue to soar amid supply-chain 'mess'. Spot rates for capesize bulkers continue to reach new heights as demand for iron ore and coal put a huge strain on the commodities supply chain, market experts said. Baltic Exchange data on last Friday showed capesize bulkers fixed for Brazil-to-China journeys at $47 per tonne of iron ore, compared to $38 per tonne a week earlier. For voyages from Western Australia to Dampier, Rio Tinto fixed an unnamed 170,000-dwt bulker at $22.10 per tonne, though the deal was done on last Thursday. The mining giant paid $19.40 per tonne for a similar fixture a week earlier. Capesize rates have skyrocketed amid tight supply and demand, port congestion and bad weather, but they may become unpredictable if they keep climbing. LNG & LPG: Shipowners and operators are moving to run their dual-fuel tonnage on fuel oil instead of LNG amid a gas price shock. The moves come as LNG prices have rocked to triple that of the fuel's alternative choices. One shipowner said the price of LNG bunkers in Rotterdam is now around $1,400 per tonne. This compares to fuel oil at $500 per tonne. Typically, LNG prices and carrier rates are correlated, Morgan said, but carrier rates have not spiked this time. Figures from Poten & Partners peg the weekly spot rate for 160,000-cbm carriers at between $70,000 and $75,000 per day and not far from the 2021 average. |

Korean Ship Owner Side –

N/A

North East Asia Ship Owner Side –

1. “CDB Leasing, 중국 Dayang 조선소에 Ultramax 벌크선 9척 발주”/“CDB Leasing swoops on nine ultramax newbuildings at New Dayang”

- 중국 개발 은행 금융 리스사는 New Dayang 조선소에 울트라막스 벌크선 9척을 발주하였다고 밝혔습니다. 해당 계약은 지난해 동 조선소에 63,000dwt 벌크선 8척을 발주한 이후 이은 계약입니다.

올해 5월초 동사는 Cosco Shipping Heavy의 Yangzhou 조선소에서 캄사르막스 8척을 발주한 바 있으며, 최근에는 John Fredriksen의 SFL Corporation에서 보유하고 있던 핸디 벌크선 7척을 인수하였습니다.

현재 동사는 2020년말 기준 운항 리스 선박85척과 금융 리스 선박 25척을 각각 운용하고 있으며 총 110척의 선대를 보유하고 있습니다. 그 중에서도 벌크선 비중은 75%, 컨테이너선은 14%를 차지하고 있습니다.

전체 선박 중에 LNG 운반선은 3척 그리고 준설선 2척 그리고 크루즈 선 1척을 각각 보유하고 있습니다.

- China Development Bank Financial Leasing (CDB Leasing) has ordered nine ultramax bulker newbuildings from New Dayang Shipbuilding.

The deal follows last year’s shipbuilding contracts with the same yard for eight 63,000 dwt bulkers. Earlier in May, CDB Leasing placed an order for eight kamsarmax bulkers at Cosco Shipping Heavy’s Yangzhou yard.

The Hong Kong-listed company has also been adding secondhand tonnage to its fleet, most recently seven handysize bulkers from John Fredriksen’s SFL Corporation.

At the end of 2020, CDB Leasing said it controlled a fleet of 110 vessels comprising 85 vessels under operating leases and 25 under finance leases.

Bulkers account for more than 75% of its fleet, with containerships making up 14%. It also has three LNG carriers, two dredgers and a cruise ship.

2. “Sovcomflot 그리고 NYK, Novatek LNG 개발 프로젝트를 위해 6척의 LNG 운반선 발주”/“Sovcomflot and NYK ink order for up to six LNG carriers for Novatek”

- 러시아 선주사인 Sovcomflot과 그 파트너사인 NYK는 Novatek 용선을 위해 삼성중공업에 6척의 LNG 운반선을 발주하였다고 밝혔습니다. 해당 계약서에는 174,000cbm LNG 운반선 확정물량 4척 그리고 옵션 물량 2척이 각각 포함되어져 있습니다.

해당 선주사들은 Novatek 자회사인 Novatek Gas & Power Asia사와 해당 선박에 대한 장기 용선 계약을 체결하였다고 밝혔습니다. 해당 신조 계약은 지난 9월에 MOL이 대우조선해양과 함께 체결한 신조 계약과 관련되어 있습니다.

해당 계약은 동일한 신조 수량으로 총 6척의 174,000cbm LNG 운반선을2024년 인도를 위해 계약을 맺었습니다. 3 선주사와의 Novatek 계약은 기존의 확정 물량 8척 보다 약간 더 많은 4척의 옵션 선박이 추가된 것으로 확인됩니다.

- Russian shipowner Sovcomflot and partner NYK Line of Japan have signed a deal with Samsung Heavy Industries to build up to six LNG carriers for charter to gas giant Novatek.

The pair contracted to build a quartet of firm 174,000-cbm vessels and have also secured two options. The owners said they signed long-term time-charter contracts on the ships with Novatek Gas & Power Asia, a subsidiary of parent Novatek.

The newbuilding contracts mirror those inked by Mitsui OSK Lines (MOL) at Daewoo Shipbuilding & Marine Engineering in September.

MOL booked the same number of 174,000-cbm vessels, to be fitted with MAN Energy Solutions ME-GA engines, for delivery dates in 2024.

The contracts with the three shipowners will give Novatek eight firm ships with options to add a further four vessels, slightly more than originally expected.

3. “NS United, 새로운 벌크선 신조선에 LNG 추진 및 베터리 추진기술 적용”/“NS United claims LNG and battery first for new limestone carrier”

- 일본 해운사인 NS United는 LNG연료유와 베터리로 구동되는 벌크 신조선을 발주한다고 입장을 밝혔습니다. 5,560dwt급 해당 신조선은 자국 자회사인 Naiko Kaiun Kaisha가 소유할 예정이며, Tsuneishi 조선소에 건조될 예정입니다.

NS United는 용선자로써 Nippon Steel Corp, Nippon Steel Cement 그리고 연료유 공급자인 Japan Petroleum Exploration 그리고 엔진 제조업체인 Kawasaki Heavy Industry 와 협력하고 있습니다. 해당 신조선은 2024년에 동 선주사로 인도될 예정입니다.

동 신조선은 기본적으로 LNG 연료유를 이용하여 운용되며, 2,847kw/hour 리튬 이온 베터리가 설치되어 LNG 연료유를 사용하지 않을 경우에 백업할 수 있는 구조로 건조될 예정입니다.

이에 선박이 긴 항로를 운항할 경우에는 LNG 연료유를 사용하게 되며, 항만내 진입하거나, 항구에 접안할 경우에는 베터리를 사용하여 무공해 운항을 할 수 있도록 합니다. 현재 NS United는 LNG, VLOC, LPG 선박으로 이루어진 68척의 선박을 보유하고 있습니다.

- Japan's NS United has revealed an order for a new coastal limestone carrier powered by LNG and batteries. The 5,560-dwt vessel will be owned by the company's domestic subsidiary Naiko Kaiun Kaisha and built at Tsuneishi Shipbuilding.

NS United has partnered with charterers Nippon Steel Corp and Nippon Steel Cement, Japan Petroleum Exploration, which is providing the fuel, and engine maker Kawasaki Heavy Industries for the project. The newbuilding is due in February 2024.

The engine will run only on LNG, the first time this has been done in Japan, with back-up from a 2,847 kW-hour lithium-ion battery. "Only natural gas will be used for high power, long distance, and long duration navigation," the shipowner said.

Power while the ship enters port and berths will be provided by the battery to achieve zero-emission operation. NS United's fleet of 68 ships includes VLOCs, LNG carriers and LPG vessels.

Ship Yard Side –

1. “Qatar Petroleum LNG, 운반선 4척 Hudong-Zhongua 조선소에 발주”/“Qatar Petroleum orders four LNG carriers at Hudong-Zhonghua”

- 중국 Hudong Zhonghua 조선소는 174,000cbm LNG 운반선 4척을 발주 받았다고 밝혔습니다. 해당 선박은 2024년 그리고 2025년에 인도될 예정입니다.

해당 신조 발주는 Qatar Petroleum의 150척 LNG 신조선 계획 중 한 부분으로써, Qatar Petroleum과 신조 슬롯을 계약한 조선사 중 Hudong Zhonghua 조선소는 그 첫 번째 조선소입니다.

2020년 계약 당시, Qatar Petroleum은 동 조선소에 확정 물량 8척 그리고 옵션 물량 8척 총 16척의 신조 슬롯을 예약하였다고 밝힌 바 있습니다.

- China's Hudong-Zhonghua Shipbuilding has won orders for four 174,000-cbm LNG carriers. The newbuildings will be delivered in 2024 and 2025.

Hudong-Zhonghua is the first shipyard to officially sign LNG newbuildings contracts with Qatar as part of its huge 150 vessel newbuilding plan.

At the time of the 2020 agreement, Qatar Petroleum is reported to have reserved 16 slots with Hudong-Zhonghua that comprise eight firm vessels and a similar number of options

Environment Side –

1. “NYK 일본 서해안내 LNG 벙커링 사업 가능성 조사”/“NYK looks to set up LNG bunkering business in western Japan”

- 일본 해운사 NYK는 자국 Itochu Enex, Sibu Gas 그리고 Kyushu Electric Power와 일본 서부에서 새로운 액화LNG 벙커링사업 가능성을 조사하기위해 협력하였다고 밝혔습니다.

4개 회사 간에 체결된 양해각서는 Setouchi 그리고 Kyushu지역에서 해양 연료 LNG를 공급, LNG 벙커링 선박 소유 및 건조 그리고 Kyushu Electric Power사에서 발주한 2023년에 인도될 LNG 추진 석탄 운반선과 같은 LNG 추진 선박에 대한 연료

사용 소비자에 대한 마케팅 활동에 대해 논의될 예정입니다. NYK는 해양 연료인 LNG가 수소와 암모니아와 같은 차세대 제로 배출 연료에 대한 가교 솔루션이 될 것으로 추측한다고 입장을 밝혔습니다.

올해 초 NYK는 2025년부터 2028년사이에 인도될 12척의 LNG 추진 자동차 운반선을 발주한 바 있습니다. 그리고 이번 달 NYK는 슈퍼 메이저 BP와 협력하여 탈 탄소화를 포함한 산업 부문을 지원하는 미래 연료 및 운송 솔루션에 대해 협력한다고 밝혔습니다.

- Japanese shipping powerhouse Nippon Yusen Kaisha (NYK) has partnered with fellow Itochu Enex, Sibu Gas and Kyushu Electric Power to examine the possibility of establishing a new liquefied natural gas (LNG) bunkering business in western Japan.

A memorandum of understanding signed between the four companies will see them work on the supply of LNG as a marine fuel in the Setouchi and Kyushu areas, marketing activities to consumers such as Kyushu Electric Power for its LNG-fueled coal carriers set to deliver in fiscal 2023 and construction and owning of LNG bunker vessels. NYK said that LNG as a marine fuel is expected to be a bridging solution to next-generation zero-emission fuels such as hydrogen and ammonia.

Earlier this year, the company ordered 12 LNG-fuelled car carriers to deliver from 2025 to 2028. This month, NYK joined forces with London-based supermajor BP to collaborate on future fuels and transportation solutions to help industrial sectors, including shipping, decarbonise.

2. “독일 세계 최초의 합성 LNG 벙커링 진행”/“Germany hosts world's first bunkering of synthetic LNG”

- 독일에서 처음으로 합성 LNG (S-LNG)를 한 선박에 벙커링을 수행하였다고 밝혔습니다. 해당 작업은 독일내 피더 컨테어니선사인 “Elbdeich Reederei”에서 운항중인 1,036teu MV. ElbBlue 선박에 20톤의 합성 LNG를 벙커링 되었습니다.

해당 합성 연료유는 독일내 Brunsbuttel 지역에서 가스 추진 트럭을 이용하여 배달되었다고 밝혀졌습니다. 합성 LNG 연료유 120톤의 양을 사용할 경우에 북해와 발트해에서 운항하는 해당 선박은 대략 56톤의 CO2를 감소할 수 있을 것으로 보고 있습니다.

합성 LNG 연료유는 저탄소 또는 재생 가능한 소스를 이용하여 물을 전기분해 하여 산소와 수소로 분해하게 되며, 분해된 수소와 산소에 이산화탄소를 추가하게 되면 메탄과 물을 생성하여 생산됩니다. 그런 다음 합성 메탄올을 액화하여 해양 벙커링을

진행 할 수 있게 됩니다. 그러나 합성 LNG 연료유의 비용과 가용성은 해양 연료유로써 사용함에 있어서 여전히 주요한 장애물입니다.

- The first bunkering of a vessel with synthetic LNG (S-LNG) has been carried out in Germany. In the pioneering operation, Elbdeich Reederei's 1,036-teu feeder containership ElbBlue (ex-Wes Amelie, built 2011) was bunkered with 20 tonnes of S-LNG.

Also referred to as synthetic natural gas (SNG), the fuel was delivered by gas-fuelled truck in Brunsbuttel. As a result of adding the S-LNG volumes to the ship's 120 tonnes of bunkers, the Unifeeder-chartered vessel, which operates in the North Sea and Baltic Sea, will see a drop in its CO2 emissions for its next voyage of 56 tonnes. S-LNG is produced by generating electricity from low-carbon or renewable sources to conduct electrolysis effectively splitting water into hydrogen and oxygen.

CO2 is added, creating methane and water. The synthetic methane can then be liquefied to produce marine bunkers. But cost and availability remain key hurdles in making S-LNG available as a marine fuel.

International Oil Prices with VLSFO –

Global Average Bunker Prices –

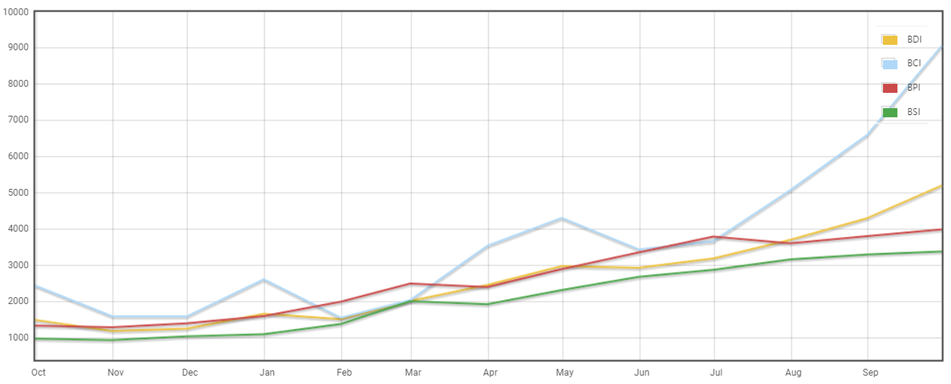

Baltic Dry Index –

During the past 1 year–

Wrriten by David Kim in WSS Korea

'해운·조선' 카테고리의 다른 글

| 42주 해운마켓브리핑 / WK42 Marine Market Briefing (0) | 2021.10.20 |

|---|---|

| 해운·조선41주 해운마켓브리핑 / WK41 Marine Market Briefing (0) | 2021.10.15 |

| 삼성重 유증, 우리사주 청약율 117% (0) | 2021.10.04 |

| “벌크선 슈퍼 사이클? 오래갈 수도 있다” (0) | 2021.10.04 |

| 시스팬, 7천teu급 10척 발주 확정 (0) | 2021.09.24 |